Singapore — Global oil markets witnessed a sharp downturn as Brent crude prices plunged below $70 per barrel, marking a 5% drop after the OPEC+ alliance postponed planned production cuts. The move triggered concerns about oversupply amid a surge in U.S. output, sending shockwaves across energy and equity markets.

Analysts said the unexpected delay highlights deep divisions within the oil cartel, while lower prices could accelerate electric vehicle (EV) adoption in Europe, where energy transition policies remain aggressive.

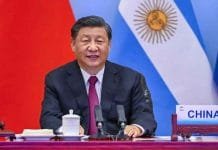

Meanwhile, China’s latest economic stimulus package sparked optimism across Asian markets, pushing regional indices up by nearly 2%, with Hong Kong and Shanghai leading the rally. The stimulus — focused on infrastructure spending and consumer demand — is expected to stabilize manufacturing output heading into 2026.