Beijing’s Energy Strategy: Filling the Tanks Amid Global Uncertainty

China is rapidly accelerating its crude oil reserve buildup, taking advantage of recent market volatility and softening global oil prices to strengthen its strategic petroleum reserve (SPR).

According to industry trackers, Beijing has increased oil imports by nearly 12% in October 2025, marking one of the largest month-over-month surges since the pandemic era.

Energy analysts suggest that China is buying up cheap barrels while Western economies remain distracted by political and economic disruptions — including the U.S. government shutdown and ongoing Middle East tensions.

“China is strategically timing its purchases — hedging against future supply shocks,” said Dr. Mei Lin, an energy economist at Fudan University. “This is both an economic move and a geopolitical one.”

🛢️ Strategic Petroleum Reserve (SPR): Nearing Capacity

China’s strategic reserve capacity now exceeds 1 billion barrels, with new underground storage sites in Shandong, Zhoushan, and Guangdong reportedly nearing full capacity.

Satellite data analyzed by commodities firm Vortexa indicates that imports from Russia, Iran, and Angola have surged, as Beijing diversifies away from U.S.-linked supply routes.

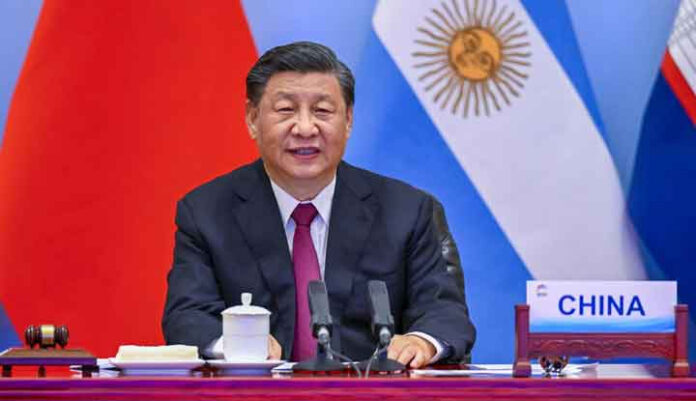

This expansion aligns with President Xi Jinping’s “energy sovereignty” directive, designed to insulate China from potential sanctions or global trade disruptions.

“The U.S. weaponized energy during previous crises,” noted Professor Chen Yu, a Beijing-based political analyst. “China’s oil buildup is its insurance policy against future American pressure.”

The move could also impact global oil prices, as China’s aggressive purchasing squeezes available supply. Brent crude rose 1.4% to $86.10 per barrel following reports of China’s October imports.

⚙️ Whole Foods 2.0: The Full Amazon Overhaul

Meanwhile, across the Pacific, Amazon is fast-tracking the complete “Amazonification” of Whole Foods, merging the grocery chain deeper into its e-commerce and AI infrastructure.

The company unveiled new features that include:

Automated AI checkouts using computer vision and predictive analytics

Ultra-fast one-hour delivery integrated with Amazon Prime logistics

AI-driven personalization, offering grocery suggestions based on user preferences and dietary data

Unified Amazon app interface, allowing customers to shop, pay, and track delivery seamlessly

“This is not just an upgrade — it’s a transformation,” said Lara Chen, VP of Retail Technology at Amazon. “We’re creating a grocery experience powered by intelligence and efficiency.”

The rollout began in New York, Seattle, and Austin, with plans to cover over 500 U.S. stores by mid-2026.

🤖 AI at the Core: From Shelves to Supply Chains

Amazon’s internal memo, leaked to Business Insider, described Whole Foods as a “testing ground for generative AI logistics.”

The new system predicts demand shifts in real-time using machine learning models trained on weather data, local events, and historical sales trends — cutting waste and improving supply chain precision.

Employees have mixed reactions. Some praise the automation of repetitive tasks, while others fear job reductions as AI systems replace human checkers and stock coordinators.

“It’s the future of food retail — smart, seamless, and slightly unsettling,” commented retail analyst David Rowe.

📈 Investor and Consumer Response

Markets reacted positively to both developments:

Oil traders expect China’s aggressive stockpiling to support prices through winter.

Amazon’s stock (NASDAQ: AMZN) gained 2.2% on Wednesday, with analysts citing its AI-driven retail strategy as “industry-leading.”

“Amazon isn’t just selling groceries — it’s collecting data that redefines how people eat, shop, and live,” said Elena Martinez, a consumer-tech strategist.

🌐 Global Implications: Energy Security Meets Digital Efficiency

These two stories — though seemingly unrelated — underscore a global theme: control through preparedness.

While China fortifies its energy security, Amazon strengthens its data and retail dominance.

Both are leveraging technology and strategy to stay ahead in an era of volatility and disruption.

“We’re witnessing the convergence of two new powers — digital sovereignty and resource sovereignty,” said Dr. Rajiv Menon, a global affairs expert at the London School of Economics