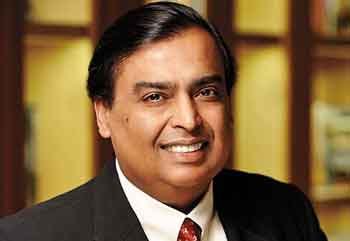

Reliance Industries Ltd. (RIL), India’s largest conglomerate led by Mukesh Ambani, witnessed a significant stock market downturn, reaching its 52-week low on Monday. The sharp decline in share prices resulted in a staggering ₹56,000 crore loss in the company’s market capitalization. Investors and analysts alike are closely monitoring the situation as RIL’s stock continues to struggle under heavy selling pressure.

Reliance Industries’ Stock Sees a Sharp Decline

The downturn in Reliance Industries’ shares marks one of the most substantial drops in recent times. According to data from the Bombay Stock Exchange (BSE), RIL’s stock was trading at ₹1,164 at 11:30 AM on Monday, reflecting a 3% decline. Last week, the stock closed at ₹1,199.60, and it opened the trading session at ₹1,209.80, only to face continuous downward movement.

This persistent decline has raised concerns among investors, as RIL is considered one of the strongest players in the Indian stock market. The fall in stock price has not only affected shareholders but has also impacted overall market sentiment.

Reliance Hits a 52-Week Low Amid Market Volatility

During Monday’s trading session, Reliance Industries’ stock plummeted to ₹1,156, marking its 52-week low. This sharp decline comes after the stock had previously reached a 52-week high of ₹1,608.95 on July 8. The stock has now fallen by 28.15% from its peak, representing a loss of ₹452.95 per share.

The steep correction has made investors cautious about RIL’s near-term prospects, as the stock’s trajectory indicates a bearish trend. Market analysts suggest that this fall could be attributed to multiple macro and microeconomic factors, including global market trends, sector-specific pressures, and investor sentiment.

Market Capitalization Drops by ₹56,000 Crore

One of the most significant consequences of this downturn is the massive erosion in market capitalization. As of the last trading session on Friday, RIL’s market cap stood at ₹16,23,343.45 crore. However, with Monday’s sharp decline, it dropped to ₹15,67,371.49 crore—an alarming ₹55,971.96 crore loss in a single trading session.

This sharp fall underscores the volatility that even market-leading companies are facing amid uncertain economic conditions. Despite Reliance Industries’ strong fundamentals and diverse business portfolio, the recent sell-off suggests that investors are exercising caution.

What Led to the Decline in Reliance Industries’ Stock?

The dramatic fall in Reliance Industries’ share price can be attributed to several key factors:

1. Weak Global Market Sentiment

Global markets have been under significant pressure due to economic uncertainties, interest rate concerns, and geopolitical tensions. This has affected investor confidence, leading to heavy selling in emerging markets, including India.

2. Profit-Booking by Investors

Given RIL’s strong rally earlier in the year, many institutional and retail investors may have chosen to book profits, leading to a decline in the stock’s momentum. Profit-booking is a common trend in highly valued stocks, especially after an extended period of growth.

3. Sectoral Weakness in Energy and Telecom

Reliance Industries has a diversified portfolio, including oil & gas, retail, and telecom businesses. Any weakness in these key sectors—especially in energy and telecommunications—can impact the company’s overall valuation. Reports of potential lower refining margins and competitive pressure in the telecom sector may have contributed to the decline.

4. Broader Market Correction

The Indian stock market has seen a broad-based correction, with several heavyweight stocks experiencing price declines. As a market leader, Reliance Industries has not been immune to this trend.

Investor Sentiment: Caution Prevails Amid Stock Plunge

Despite the sharp decline, long-term investors continue to believe in Reliance Industries’ growth story. The company has consistently delivered strong financial results, expanded its digital and retail businesses, and maintained a leadership position across multiple sectors.

However, short-term traders and institutional investors remain cautious, as technical indicators suggest further volatility. Many analysts are keeping a close watch on support levels and market trends before making any investment decisions.