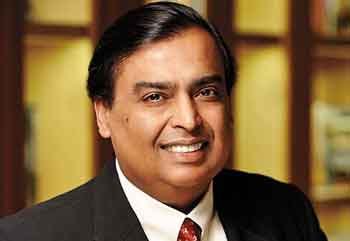

In the world of business, few names shine as brightly as Mukesh Ambani, the chairman and managing director of Reliance Industries Limited (RIL). Ranked among the top 20 richest individuals globally and the wealthiest businessman in Asia, Ambani has once again demonstrated his financial acumen by capitalizing on the geopolitical shifts in global oil trade. While the United States and its allies imposed sanctions on Russian oil following the Ukraine conflict, India strategically positioned itself as a major importer of Russian crude. Through refining and re-exporting, India has significantly boosted its export revenue, with Reliance Industries emerging as a key player in this lucrative market.

How India Benefited from Russian Oil Sanctions

Following the Western sanctions on Russian crude oil in 2022, India saw an opportunity to acquire oil at significantly discounted prices. As European and American companies distanced themselves from Russian crude, Indian refiners, including Reliance Industries and Nayara Energy, ramped up their purchases. This move not only strengthened trade relations between India and Russia but also positioned India as a global refinery hub.

Key Benefits of India’s Oil Strategy:

- Acquisition of Russian crude at lower prices, improving refining margins.

- Processing and refining Russian crude into fuels such as diesel and petrol.

- Exporting refined fuels to markets in the US, Europe, and other nations.

- Boosting foreign exchange earnings and strengthening India’s refining industry.

Mukesh Ambani’s Reliance Industries: Leading the Charge

Among India’s oil refiners, Reliance Industries has emerged as a dominant force in the global energy market. The company operates the world’s largest refining complex in Jamnagar, Gujarat, with two refineries that have a combined capacity of 1.24 million barrels per day (bpd).

Reliance Industries’ Massive Earnings from Russian Oil

According to a report by the Center for Research on Energy and Clean Air (CREA), Reliance Industries earned approximately €724 million (₹6,850 crore) from fuel exports refined from Russian crude to the US between January 2024 and January 2025. The report highlights that the US imported €2 billion worth of fuels, such as petrol and diesel, from Reliance’s Jamnagar refineries.

Key Figures from the CREA Report:

- Total US imports of refined oil from India and Turkey: €2.8 billion

- Revenue generated from refining Russian crude: €1.3 billion

- Reliance’s share in refined oil exports to the US: €2 billion

- Estimated share refined from Russian crude: €724 million

The Loophole in Western Sanctions

Despite stringent restrictions on Russian crude oil, a key loophole allowed India to purchase, refine, and export fuels without violating sanctions. The Western embargo focused on direct Russian oil exports, but refined products—such as petrol, diesel, and jet fuel—could still be freely traded in international markets.

This allowed companies like Reliance Industries to continue selling refined fuels, indirectly channeling Russian oil into Western markets.

How the Sanctions Work:

- Direct import of Russian crude oil is banned in the US and Europe.

- India and Turkey purchase Russian crude at discounted rates.

- These countries refine the crude into fuel products.

- Refined fuels are exported to Western markets without restrictions.

This system has allowed major refiners, including Reliance Industries and Nayara Energy, to capitalize on high refining margins and increased global demand for petroleum products.

Other Indian Refineries Benefiting from Russian Crude

While Reliance Industries leads the market, other Indian refiners have also profited from processing Russian oil and exporting refined fuels.

Nayara Energy:

- Owned partly by Russia’s Rosneft, operates a 20 million tonne per annum refinery in Vadinar, Gujarat.

- Exported fuel worth €184 million to the US between January 2024 and January 2025.

- €124 million of this revenue was derived from refining Russian crude.

Mangalore Refinery and Petrochemicals Limited (MRPL):

- Exported €42 million worth of fuel to the US during the same period.

- €22 million was estimated to be refined from Russian crude.

Turkey’s Role in the Trade

- Turkey’s three major refineries exported €616 million worth of fuel to the US.

- €545 million of this total originated from Russian crude.

- Collectively, Russia earned approximately $750 million from exports to the US via India and Turkey.

The Impact on Global Oil Markets

Mukesh Ambani’s Reliance Industries has not only profited immensely from refining Russian crude but has also strengthened India’s position in the global energy market. The strategic acquisition of cheap Russian crude has allowed India to become an export powerhouse for refined fuels, while Western nations continue to rely on imports despite imposing sanctions on Russia.

Key Implications of This Oil Trade:

- India’s refining sector has gained a competitive edge by securing cheap feedstock.

- Western countries remain indirectly dependent on Russian crude, processed by India and Turkey.

- Reliance Industries’ revenue surged significantly, further consolidating Mukesh Ambani’s position as a global business leader.

India has strengthened its geopolitical and trade relations with both Russia and Western nations by leveraging its refinery capacity.