Mexico City / New Delhi, : In a dramatic escalation of global trade tensions, Mexico has announced tariffs of up to 50% on imports from India and several Asian countries, effective January 1, 2026. The move threatens to upend a rapidly expanding bilateral trade relationship worth $18 billion annually, with major Indian sectors—textiles, pharmaceuticals, and auto components—bracing for heavy losses.

The tariff hike, outlined in a decree signed by President Claudia Sheinbaum, is aimed at shielding Mexico’s domestic industries amid intensifying pressure from the United States under the USMCA pact. Mexican officials claim the surge in Asian imports has created market distortions and contributed to pricing instability.

India is among the biggest casualties. Indian exports to Mexico grew 25% in 2025 to reach $12 billion, led by steel, chemicals, and machinery. Analysts warn the new tariff structure could add up to $6 billion in additional costs for major Indian firms such as Tata Steel, Sun Pharma, and hundreds of small and medium exporters.

Indian Commerce Minister Piyush Goyal condemned the move as “unilateral and regrettable,” announcing India will seek WTO consultations. Exporters’ association FIEO, led by Ashwani Kumar, warned the decision could trigger 100,000 job losses across India’s manufacturing hubs.

On the Mexican side, Economy Minister Marcelo Ebrard defended the measure, citing “repeated dumping concerns” and the need to protect local industries from becoming “collateral damage in U.S.-driven supply chain realignment.”

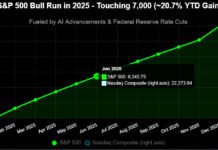

The announcement comes at a time of heightened economic uncertainty. Following the U.S. Federal Reserve’s third rate cut to 4.25% on December 10, emerging markets saw temporary relief, but India’s rupee fell to a record low of 85.50 per dollar, worsening import costs and complicating trade negotiations.

Mexico’s government, grappling with 6% inflation, is framing the tariffs as a step toward “economic sovereignty.” However, critics such as opposition PAN leader Marko Cortés blasted the decree as “blatant protectionism that will hurt consumers and trade partners alike.”

For India, the tariff shock adds to mounting pressures from EU carbon border taxes, prompting economic strategists to push for expanded PLI schemes, diversified export markets, and deeper engagement with Latin American economies beyond Mexico.

Deloitte analysts project a 15% decline in India–Mexico trade in 2026 unless the tariff dispute is resolved quickly, warning that prolonged tensions could disrupt global supply chains across pharmaceuticals, textiles, autos, and specialty chemicals.