Tokyo, December 1, 2025 :

Japan’s government bond market has descended into its most severe crisis in over a decade, with 10-year JGB yields spiking to 1.81%, the highest level since June 2008, triggering panic across global financial markets. The turmoil is being fueled by an unprecedented short-selling frenzy, with futures open interest hitting 188,000 contracts, up 65,000 since June—a clear indication of aggressive bets against Japanese debt.

Bond prices have plunged 2.6% to 135, the weakest in 17 years, as the Bank of Japan scales back its long-standing bond purchases. Domestic insurers—once stabilizing buyers—have turned net sellers, amplifying market volatility.

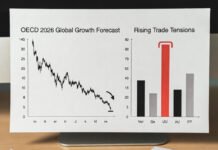

Prime Minister Shigeru Ishiba’s massive ¥30 trillion stimulus package has accelerated bond issuance, pushing Japan’s national debt to 260% of GDP, the highest among advanced economies. The weakening yen, now at 150 per USD, has prompted foreign investors to exit Japanese markets at a rapid pace.

BOJ Governor Kazuo Ueda faces a policy trap:

Raise interest rates, which could tip Japan into recession, or

Resume unlimited bond buying, which risks further currency collapse.

Finance Minister Shunichi Suzuki continues to defend Japan’s fiscal position, but markets remain unconvinced as banks face ¥2 trillion in potential losses, prompting forced asset sales reminiscent of past financial shocks.

The fallout is already being felt globally. Analysts at JPMorgan warn that Japanese investors pulling money from overseas could push U.S. Treasury yields up by 20 basis points, creating ripple effects across international bond markets.

At home, the yen’s 10% drop in 2025 is feeding into import inflation, raising household costs. Even staples like rice have seen 3% price increases, straining consumer budgets. Tokyo’s stock market fell 1.5% amid fears of systemic instability, while gold surged as investors sought safe havens.

Financial analysts caution that Japan could face a “Liz Truss moment”, referencing the UK’s 2022 bond crisis, unless decisive intervention occurs. With Japan’s aging population and pension funds heavily exposed to government bonds, risks of a deepening fiscal spiral are growing.

Many believe recovery depends on U.S. Federal Reserve rate cuts, but Ishiba’s election pledges, which add another ¥10 trillion in spending, may further complicate Japan’s fragile financial balance.