INVC NEWS

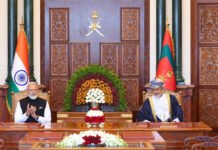

New Delhi : In a significant development aimed at enhancing bilateral ties and fostering economic progress, Sri Lankan President Ranil Wickremesinghe recently visited India on a 2-day official trip. The visit included crucial meetings with Indian Prime Minister Narendra Modi, wherein both leaders engaged in productive discussions and negotiations. One of the highlights of this visit was the groundbreaking agreement to implement the Indian Unified Payments Interface (UPI) in Sri Lanka. This collaboration is poised to bring about transformative changes to Sri Lanka’s financial landscape, making transactions faster, more secure, and convenient for citizens and businesses alike.

Strengthening Bonds Between India and Sri Lanka

The historical and cultural connections between India and Sri Lanka have endured for centuries, laying the foundation for a robust diplomatic relationship. PM Modi emphasized the ancient and extensive nature of these ties during the meetings. As part of efforts to strengthen these bonds further, both countries have decided to enhance air connectivity and launch a passenger ferry service, facilitating easier travel and fostering greater people-to-people exchanges.

The Indian Unified Payments Interface (UPI) in Sri Lanka

With the signing of the agreement to introduce the Indian UPI system in Sri Lanka, the financial landscape of the island nation is poised for a major transformation. UPI has revolutionized digital payments in India, and its implementation in Sri Lanka is expected to drive financial inclusion, promote cashless transactions, and boost the overall economy.

Advantages of UPI Implementation in Sri Lanka

- Seamless Transactions: UPI enables swift and seamless money transfers between bank accounts using a unique virtual payment address (VPA). This system will allow Sri Lankans to make instant transactions, reducing the reliance on traditional banking methods and paper-based payments.

- Secure and Efficient: UPI transactions are highly secure, as they require two-factor authentication. This ensures that users can perform transactions without worrying about data breaches or fraudulent activities.

- Promoting Financial Inclusion: The introduction of UPI in Sri Lanka will foster financial inclusion by bringing the unbanked population into the formal financial system. This will empower individuals and businesses with access to various financial services.

- Boosting E-commerce: The ease of digital transactions offered by UPI will fuel the growth of the e-commerce sector in Sri Lanka. With a more efficient payment system, online businesses can expect increased customer engagement and higher conversion rates.

- Encouraging Cashless Economy: As Sri Lanka adopts the UPI system, there will be a natural shift towards a cashless economy. Reduced reliance on physical currency will not only streamline transactions but also curb the circulation of counterfeit money.

- Cross-Border Transactions: UPI’s implementation will facilitate cross-border remittances between India and Sri Lanka, simplifying international transactions for individuals and businesses.

Commitment to Overcoming Challenges

During the discussions, PM Modi acknowledged the challenges faced by Sri Lanka in the past year. He assured President Wickremesinghe that India would continue to stand by Sri Lanka and extend support during difficult times. The bilateral talks reflected India’s commitment to assist Sri Lanka in overcoming challenges and progressing towards a brighter future.

The Aspirations of Tamils

One of the critical aspects addressed during the meeting was the aspirations of the Tamil community in Sri Lanka. PM Modi expressed hope that the Government of Sri Lanka would take significant steps towards ensuring equality, justice, and peace for the Tamils. Emphasizing the importance of inclusivity and harmonious coexistence, India pledged its support in fostering an environment where all communities in Sri Lanka can thrive and prosper.

The Road Ahead

As the implementation of UPI in Sri Lanka takes center stage, both countries are gearing up to embrace new opportunities for economic growth and cooperation. The signing of this agreement signifies a new chapter in the bilateral relations between India and Sri Lanka, underlining the commitment to mutual progress and development.

With UPI’s integration, Sri Lanka is set to witness a wave of digital transformation that will empower its citizens and businesses. As the benefits of the Indian UPI system become evident, Sri Lanka is likely to experience a surge in digital innovation, fintech startups, and increased investor interest.

Conclusion

The recent visit of Sri Lankan President Ranil Wickremesinghe to India and the ensuing bilateral talks with PM Narendra Modi have laid the groundwork for a stronger and more prosperous relationship between the two nations. The agreement to introduce the Indian Unified Payments Interface (UPI) in Sri Lanka is a significant step towards fostering financial inclusion, driving economic growth, and advancing digitalization.

As the implementation of UPI gains momentum, Sri Lanka can look forward to a future marked by seamless transactions, increased financial accessibility, and accelerated economic development. The mutual commitment to supporting each other during challenging times and promoting the aspirations of all communities is a testament to the enduring friendship between India and Sri Lanka.

With the successful implementation of UPI in Sri Lanka, both countries can embrace a new era of cooperation and progress, harnessing the power of technology to uplift their societies. The strategic partnership forged through this historic visit will undoubtedly pave the way for a brighter and more prosperous future for India and Sri Lanka.