New Delhi, India – December 3, 2025 :

The Indian rupee plunged to a historic low on December 3, 2025, crossing the 90-per-dollar mark for the first time, as persistent foreign outflows, weakening global risk sentiment, and uncertainty surrounding a key India–US trade deal intensified pressure on the currency. The dramatic fall prompted the Reserve Bank of India (RBI) to step in with targeted dollar sales to curb volatility and prevent a deeper slide.

Currency markets reacted sharply to the ongoing delays in the bilateral trade agreement, which has put nearly $2 billion worth of summer apparel orders at risk. Exporters’ associations warned that the uncertainty is hurting production planning and eroding competitiveness at a critical time for India’s garment and textile industry.

RBI Steps In as Rupee Breaches New Lows

RBI officials confirmed active intervention in the foreign exchange market after the rupee slipped past the 90 threshold, a level that triggers systemic and inflationary concerns. Governor-led teams monitored spot and forward markets closely, with traders reporting sizable dollar sales by the central bank to stabilize sentiment.

Finance Ministry officials acknowledged that the currency decline reflects a broader wave of global monetary tightening, geopolitical disruptions, and fragile trade flows impacting emerging markets.

Foreign Outflows and Weak Domestic Offsets Deepen Pressure

The currency has remained under pressure due to sustained foreign portfolio investor (FPI) outflows, with global funds reducing exposure to Indian equities amid shaky earnings and rising global uncertainties. Analysts note that the lack of “strong domestic offsets”—such as high export inflows or robust private investment cycles—has made the rupee more vulnerable than regional peers.

Consumption Trends Add Another Layer of Concern

Unexpected domestic consumption patterns also drew attention in the latest market commentary. Analysts highlighted rising alcohol market premiums and increasing dependence on ultra-processed foods delivered through quick-commerce apps, raising long-term public-health concerns—especially among Gen Z consumers. While not directly related to currency movements, these trends reflect broader shifts in domestic economic behavior during periods of stress.

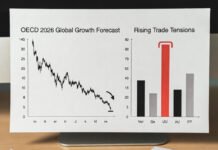

A Reflection of Broader Global Trade Tensions

Economists believe the rupee’s slide mirrors a wider global trend of trade fragmentation and uncertainty, with geopolitical tensions reshaping supply chains and weakening investor confidence worldwide. India’s exposure to global trade cycles and dependence on imports—especially energy—make the currency more sensitive to international shocks.

Export organizations urged the government to expedite trade negotiations, strengthen incentive structures, and issue clear policy guidance to avoid further disruptions ahead of the 2026 fiscal cycle.