New Delhi, December 2, 2025 :

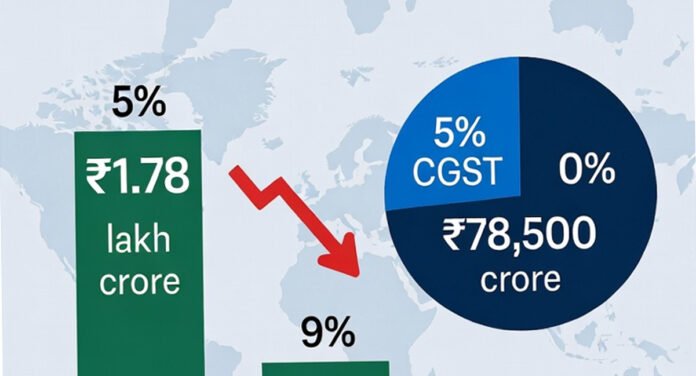

India’s Goods and Services Tax (GST) revenues slipped to a 12-month low of ₹1.70 lakh crore in November 2025, reflecting a sharp post-festive slowdown in consumer spending after Diwali. The latest Finance Ministry data, released on December 2, shows overall growth of just 0.7% year-on-year after excluding ₹25,000 crore collected as cess on sin goods.

The revenue breakdown highlights widening pressure points: central GST fell 2% to ₹32,000 crore, state GST edged up 1.5% to ₹41,000 crore, while integrated GST from imports dropped 5% to ₹78,000 crore, signaling contracting global trade and lower inbound shipments.

Revenue Secretary attributed the weak print to “one-off base effects,” but economists caution that subdued household demand and tightening credit conditions may persist into Q4. The Reserve Bank of India, meanwhile, flagged inflation heating up to 5.8%, adding further strain to consumption.

State-wise, Maharashtra retained the top spot with ₹22,000 crore, followed by Karnataka at ₹14,000 crore. However, several industrial states registered month-on-month declines, reflecting softer manufacturing and e-commerce activity. Online platforms, including Amazon India, reported a 10% drop in November sales, tempering expectations of strong festive momentum.

The downturn comes as Parliament’s winter session debates the GST 2.0 Bill, a major reform proposal aimed at rationalizing slabs and easing compliance. Opposition leader Mallikarjun Kharge demanded immediate relief for small and medium enterprises hit by 15% hikes in input taxes, arguing that the current structure is stifling growth.

Analysts at Deloitte revised India’s Q3 GDP growth forecast to 6.5%, urging the RBI to consider a December rate cut to stimulate demand. With over 1.3 crore GST registrants affected, policymakers are under pressure to revive consumption, streamline tax structures, and shore up revenues ahead of the FY2026 Budget.