NEW YORK — December 28, 2025

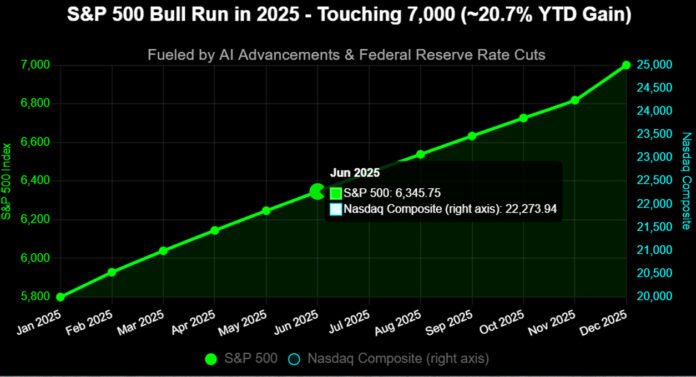

The S&P 500 is on the verge of reaching the historic 7,000 level in the final trading days of 2025, poised to conclude a robust year with gains of nearly 18%.

Fueled by persistent optimism around artificial intelligence and a series of Federal Reserve interest rate reductions totaling 75 basis points—bringing the benchmark federal funds rate to 3.50%-3.75%—major U.S. stock indexes have demonstrated remarkable resilience. The technology-heavy Nasdaq Composite has outperformed with gains exceeding 22%, led by megacap companies despite intermittent volatility from trade tariff concerns earlier in the year.

Market participants are anticipating a positive year-end finish, supported by solid U.S. economic indicators and expectations for additional monetary easing in 2026. Federal Reserve policymakers remain divided on the pace of future cuts, reflecting balanced views on inflation and employment risks.

Broader market dynamics show signs of rotation into cyclical sectors such as financials, indicating expanding participation beyond tech giants. This follows a recovery from turbulence early in 2025, underscoring the economy’s underlying strength amid policy shifts.

As trading volume remains light heading into the holidays, the S&P 500’s push toward 7,000 symbolizes investor confidence in continued corporate earnings growth and innovation-driven productivity.