WASHINGTON — December 28, 2025

U.S. corporate bankruptcies reached a 15-year high in 2025, with more than 700 large companies filing for protection through November, rivaling levels seen in the aftermath of the Great Recession.

Data from S&P Global Market Intelligence showed at least 717 filings for public and private companies of significant size from January to November, marking a 14% increase from the prior year and the highest annual pace since 2010. The surge highlights mounting financial stress across sectors, particularly those reliant on imports.

President Donald Trump’s aggressive tariff policies played a key role, raising input costs and disrupting supply chains for businesses unable to fully pass on expenses amid cautious consumer spending. Combined with lingering inflation and elevated interest rates, these factors squeezed margins, especially in manufacturing—the hardest-hit sector with nearly 100 filings—and consumer discretionary industries.

Notable cases included ultra-low-cost carrier Spirit Airlines, which filed for Chapter 11 protection a second time amid operational challenges; accessories retailer Claire’s, entering bankruptcy for the second time in seven years due to shifting shopping habits and debt; and pharmacy chain Rite Aid, which filed again and ultimately ceased operations, closing all locations.

Economists point to a broader contradiction in the U.S. economy: robust overall GDP growth contrasted with uneven distribution of pressures on smaller and import-dependent firms. Mega-bankruptcies—those involving over $1 billion in liabilities—also rose sharply, underscoring vulnerability in larger enterprises.

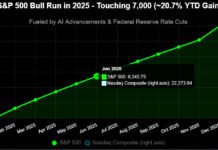

As 2025 draws to a close, experts warn of potential ripple effects into 2026, including job losses and supply chain disruptions, though stock markets have largely shrugged off the distress.