New York, December 2, 2025

Global financial markets suffered a major downturn on Tuesday as President Donald Trump’s renewed tariff threats on China and Mexico triggered widespread recession fears, erasing nearly $1 trillion in market value and defying the typically bullish December trend.

On December 2, the Dow Jones Industrial Average sank 400 points (0.9%), the S&P 500 slipped 0.5%, and the Nasdaq fell 0.4%, wiping out all gains made in November. Market participants described the pullback as an “anti-Santa rally”—a stark contrast to the strong year-end performance usually seen during the holiday season.

The selling intensified after the Federal Reserve signaled it would not cut interest rates in December, dampening expectations for policy support amid tightening financial conditions. Commodities moved in the opposite direction, with silver hitting a record $32 per ounce, reflecting rising demand for safe-haven assets.

Cryptocurrencies were not spared. Bitcoin plunged 5% to $85,000, extending losses driven by heightened regulatory uncertainty under the incoming Trump administration.

Treasury Secretary nominee Scott Bessent attempted to reassure investors, urging calm and emphasizing that ongoing trade negotiations would prevent long-term damage. Still, Wall Street analysts remain unconvinced.

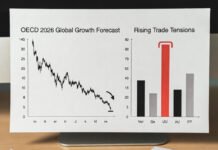

Goldman Sachs warned that if Trump proceeds with proposed 25% tariffs, the U.S. could suffer a 1.5% GDP hit, with global spillovers likely to deepen. Markets are already pricing in slower growth across Asia and Europe.

Despite the broader sell-off, pockets of resilience emerged. Nvidia’s $2 billion investment in Synopsys provided a short-lived boost to the semiconductor sector, helping limit deeper losses in tech-heavy indices.

With volatility rising and recession anxieties mounting, analysts expect markets to remain turbulent through December, particularly as investors await clarity on Trump’s trade strategy and the Fed’s outlook for early 2026.