New York | November 30, 2025 :

Bitcoin exploded through the $100,000 barrier on November 30, 2025, closing at $101,000 and marking a stunning 150% rally this year. This historic surge is fueled by massive institutional inflows, groundbreaking ETF approvals, and crypto-friendly policies championed by the Trump administration. Fundstrat’s Tom Lee forecasts Bitcoin will soar to $250,000 by year-end, driven by $50 billion absorbed via ETFs and halving-induced supply reductions.

The bullish momentum extends beyond Bitcoin: Ethereum climbed 20% to $4,200, and MicroStrategy’s Michael Saylor bolstered BTC holdings by 10,000 coins, catapulting his portfolio to 300,000 BTC valued at $30 billion. Trump’s post-election proposal for a Bitcoin strategic reserve bolstered investor confidence, while Federal Reserve rate cuts alleviated inflation fears, paving the way for further gains.

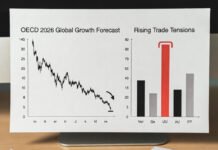

Yet challenges persist. China’s crypto mining ban has displaced 40% of the global hash rate to Texas, while environmental concerns gather attention as Bitcoin’s energy consumption rivals that of Argentina, prompting EU carbon taxes. In India, the Reserve Bank’s 30% crypto tax curbs adoption despite 20 million active traders on WazirX. BlackRock’s iShares ETF continues attracting $2 billion weekly, bolstering liquidity.

This year’s rally contrasts sharply with 2022’s crash, revitalizing decentralized finance, now boasting $200 billion total value locked. Though skeptics like JPMorgan’s Jamie Dimon warn of a looming bubble, retail investors are undeterred—Robinhood reports 5 million new crypto accounts. Internationally, El Salvador’s Nayib Bukele highlights a remarkable 300% profit from Bitcoin reserves.