Beijing | December 1, 2025 :

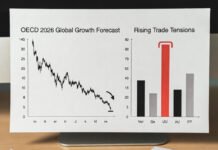

China’s manufacturing sector slipped back into contraction in November 2025, with the Caixin Manufacturing PMI dropping to 49.2, marking its first dip below the expansion threshold since August. The decline comes amid renewed U.S. tariff pressures, fading overseas demand, and persistent domestic deflationary challenges.

Factory output fell 0.5%, while new orders dropped 1.2%, driven largely by weak global demand. Exports to the United States plunged 8% year-on-year, underscoring the impact of trade tensions and a sluggish external environment. Employment also weakened, with an estimated 15,000 factory jobs lost, affecting small and mid-sized manufacturers the most.

Premier Li Qiang pledged support through a 500 billion yuan infrastructure bond stimulus, but economists remain cautious. Nomura’s chief economist Ting Lu now projects 4.5% GDP growth, below Beijing’s 5% official target, reflecting structural vulnerabilities in China’s post-pandemic recovery.

Sector-wise, electronics production contracted 2%, hit by global tech softness, while the auto industry saw a modest 1% uptick, supported by strong EV subsidies. International commodities reacted immediately—iron ore prices slid 3% on fears of weakened Chinese demand.

The PMI downturn follows China’s Q3 growth of 4.6%, intensifying expectations of US Federal Reserve rate cuts as global slowdown risks rise.